Is Your Law Firm Reclaiming its Foreign VAT?

Law firms often overlook foreign VAT reclaim as a mechanism to contribute cash flow to their bottom lines. This article discusses the ways a law firm can harness cross-border VAT recovery to add value to their businesses. Every law firm’s finance...

Law firms often overlook foreign VAT reclaim as a mechanism to contribute cash flow to their bottom lines. This article discusses the ways a law firm can harness cross-border VAT recovery to add value to their businesses. Every law firm’s finance department should have clear strategies around VAT reclaim and compliance because VAT leakage worsens as a company increases its foreign travel meaning any law firm with a global footprint or clientele, may be missing out on maximising their VAT yield.

Why Don’t Law Firms Claim Their VAT?

There are two reasons why tax departments within law firms do not claim their foreign VAT.

Firstly, the VAT reclaim process is cumbersome. The process for auditing employee Travel & Entertainment costs is especially onerous and dealing with multiple VAT authorities in many countries throughout Europe, Japan and Australia can be a bureaucratic nightmare.

Secondly, many law firms believe that any VAT refunded to them that was incurred on billable travel should be refunded back to their clients. Mapping the refund back to the client’s case can be heavily administrative and therefore many choose to forego the refunds entirely to avoid unwanted administration.

Two Ways to Claim VAT Back Easily for Your Law Firm

Outsource

VAT reclaim and compliance is not something that your tax team needs to do inhouse. A company such as ours can provide an end-to-end outsourced solution for all VAT reclaim and compliance needs – from foreign A/P and T&E VAt refunds to local VAT registrations and domestic VAT compliance

Data Makes Tying it Back to Your Clients’ Projects Easy

It’s important to iterate that any law firm or consultancy company is within their right to keep any VAT refunds received for their own cash flow purposes. However, if your law firm is adamant on refunding the VAT back to a client, the integration of our VAT software and expense management systems have made this task seamless. This can work on two ways.

As a first option, your firm could opt to use expense and VAT refund Data from our proprietary software, VAT Cloud to tie back to the exact client or project that the expense would fall under in your expense management software. The process is seamless and your finance team needn’t have to lift a finger except to pay your clients back and accept their thanks.

As a second option, should your firm use an expense management system that categorizes billable expenses and non-billable expenses, then we would be able to claim VAT refunds on only non-billable expenses and would only pull the data we needed from those expenses. This way ensures that you are only receiving refunds for expenses that were not client-related and therefore are yours to keep.

What is the VAT Savings Potential for Law Firms?

The opportunities for VAT savings for any consultancy-type business are based on employee count and employee frequency of international travel. To illustrate, the higher the employee number and frequency of travel, the higher your VAT exposure and consequently, the higher the VAT refund potential. While it has become easier using online platforms to communicate remotely, paradoxically, we’ve seen a 100% increase in foreign spend among our law firm clients which suggests that international travel rises with company growth.

Law Firm VAT Stats (2014 – 2019)

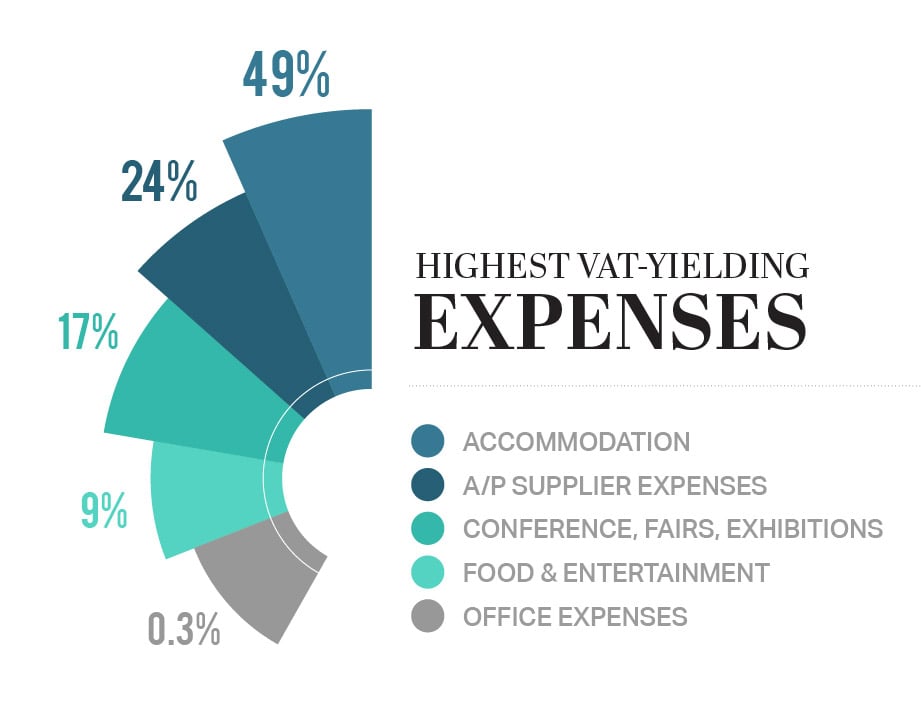

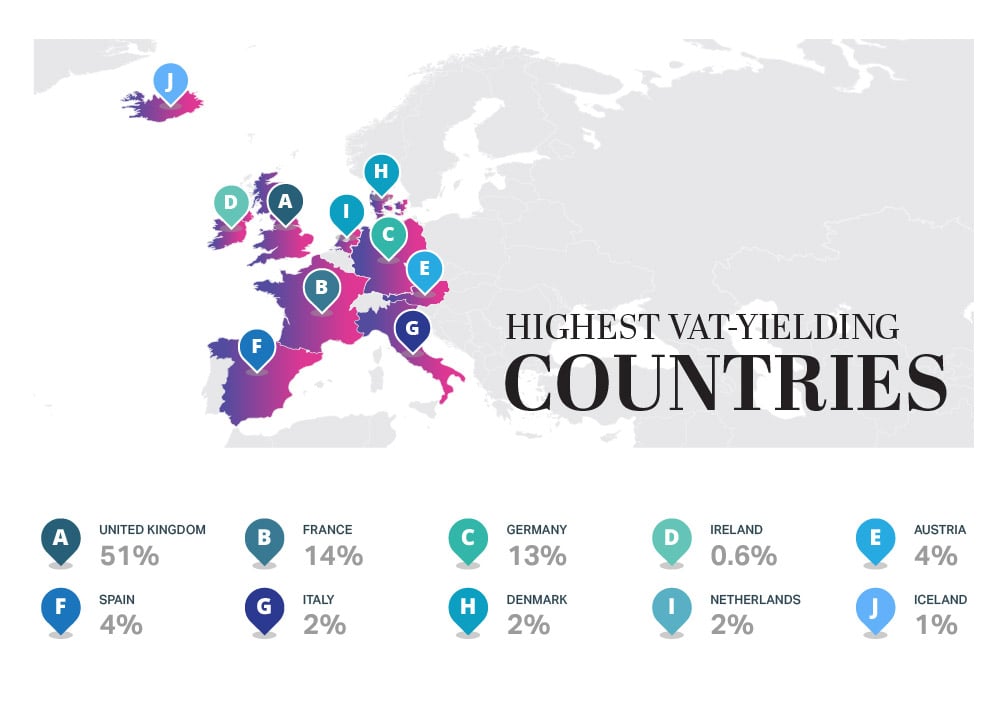

The below stats show some interesting spend-related data around Foreign VAT reclaim opportunities specifically for law firms that we have seen among our clients.

Highest VAT-Yielding Expenses

Highest VAT-Yielding Countries

Conclusion

As a law firm, taking advantage of European VAT reclaim opportunities should be a no brainer but often it’s small logistical hurdles that scare off a finance team from jumping in and moreover cashing in on the VAT that is rightfully yours. Furthermore, you don’t have to do this alone. VAT IT is the global leader in VAT reclaim and compliance and can assist your law firm with it’s foreign VAT reclaim.

Related blogs

VAT refund Tool kit

Contact Us

Come explore your refund possibilities.

Chat with us today.

Find out how you could turn company spend into income